The Impact of GDPR on Post-Trade Data Management: A Comprehensive Analysis

Learn about GDPR and its impact on post-trade operations. Discover the challenges, opportunities, and best practices for compliance. Get expert insights here.

The General Data Protection Regulation (GDPR) is a comprehensive privacy regulation that took effect in May 2018. It aims to protect the privacy of individuals by regulating the processing of personal data. The regulation applies to all companies that process the personal data of EU citizens, regardless of where they are located. The GDPR has far-reaching implications for businesses, particularly in post-trade data management.

Post-trade data management involves collecting, processing, and analyzing data related to financial transactions after they have been executed. This data is used for various purposes, including risk management, regulatory reporting, and business intelligence. The GDPR has significant implications for post-trade data management, as it requires companies to ensure the privacy and security of personal data throughout its lifecycle.

The GDPR has forced financial institutions to rethink their business models and compliance strategies. They must now ensure robust data management processes to comply with the regulation. Failure to comply with the GDPR can result in significant fines and reputational damage. The role of technology in compliance has become increasingly important as companies seek to automate data management processes and reduce the risk of human error.

Key Takeaways

- The GDPR has significant implications for post-trade data management, as it requires companies to ensure the privacy and security of personal data throughout its lifecycle.

- Financial institutions must ensure that they have robust data management processes to comply with the regulation or face significant fines and reputational damage.

- The role of technology in compliance has become increasingly important as companies seek to automate data management processes and reduce the risk of human error.

Understanding GDPR

The General Data Protection Regulation (GDPR) is a regulation in EU law on data protection and privacy for all individuals within the European Union (EU) and the European Economic Area (EEA). It came into effect on May 25, 2018, and replaced the 1995 Data Protection Directive. The GDPR aims to give individuals more control over their data and to harmonize data protection laws across the EU.

The GDPR defines personal data as any information relating to an identified or identifiable natural person, such as a name, identification number, location data, or online identifier. Processing of personal data is only allowed if the data subject has given consent, if it is necessary for the performance of a contract, or if it is required for compliance with a legal obligation.

One of the fundamental principles of the GDPR is that individuals have the right to access their data and to have it corrected or deleted if it is inaccurate or incomplete. The GDPR also requires organizations to implement appropriate technical and organizational measures to ensure the security of personal data.

Confidentiality is also an essential aspect of the GDPR. Organizations must ensure that personal data is processed for appropriate security, including protection against unauthorized or unlawful processing and accidental loss, destruction or damage.

Overall, the GDPR significantly impact privacy and data protection, both within the EU and globally. It has increased awareness of privacy issues and forced many organizations to review and update their data protection policies and procedures.

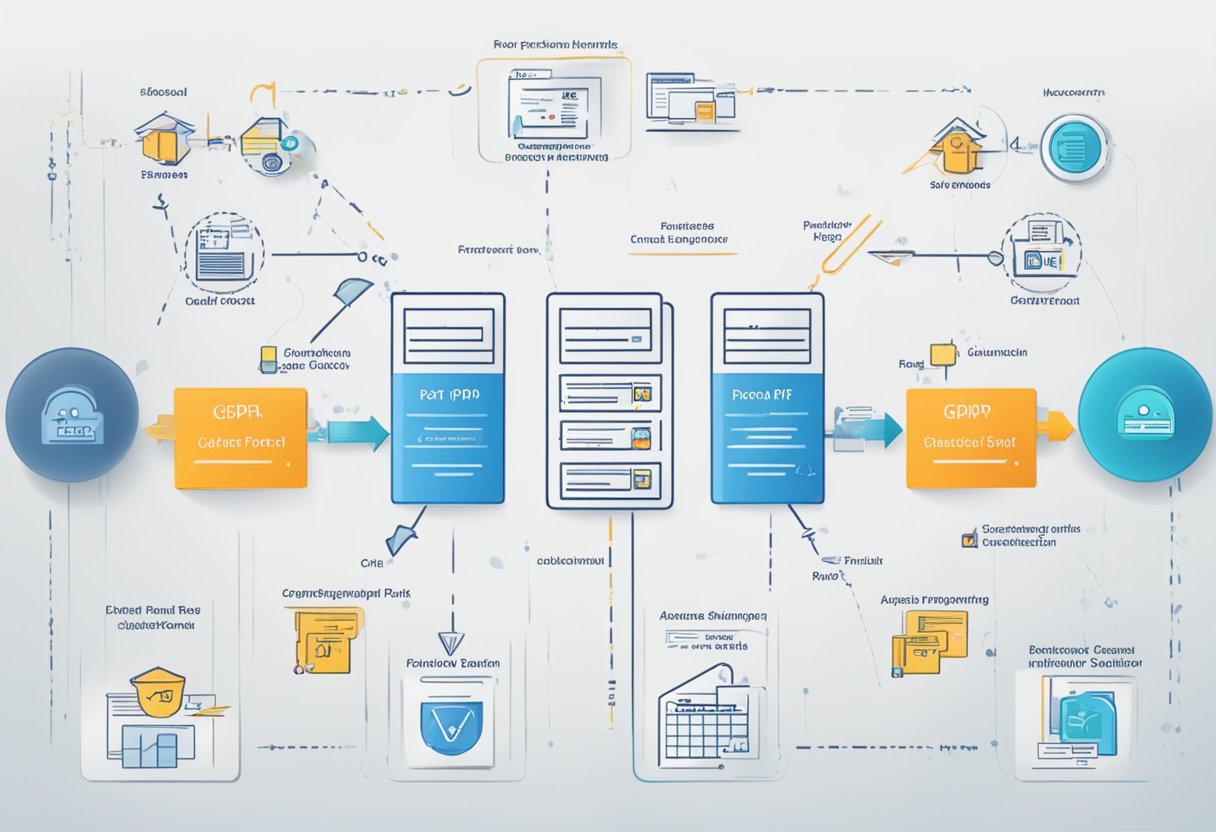

GDPR and Data Management

The General Data Protection Regulation (GDPR) has significantly impacted post-trade data management. It has introduced new rata security and consent requirements, forcing companies to re-evaluate their data management processes and policies. In this section, we will explore the role of data security and the importance of consent in post-trade data management under GDPR.

Role of Data Security

GDPR requires companies to implement appropriate technical and organizational measures to ensure the security of personal data. Companies must protect the confidentiality, integrity, and availability of personal data. They must also ensure that personal data is not accidentally or unlawfully destroyed, lost, altered, or disclosed.

In post-trade data management, data security is critical because of the sensitive nature of the data involved. Trade data, for example, can include information about financial transactions, which can be highly confidential and valuable. Companies must protect this data from unauthorized access, disclosure, or alteration.

Companies must implement appropriate security measures, such as encryption, access controls, and monitoring systems, to achieve this. They must also conduct regular risk assessments to identify and mitigate potential security threats.

Importance of Consent

GDPR requires companies to obtain explicit and informed consent from individuals before collecting, processing, or sharing their data. Companies must provide individuals with clear and concise information about how their data will be used and obtain their consent before processing it.

In most trade data management, obtaining consent can be challenging because of the complex nature of the data involved. Trade data, for example, can include information about multiple parties, including buyers, sellers, and intermediaries. Companies must obtain consent from all relevant parties before processing this data.

Companies implement appropriate consent mechanisms, such as consent forms or privacy notices. To achieve this, They must also ensure that individuals have the right to withdraw their consent at any time and that their data is deleted if they do so.

In conclusion, GDPR has had a significant impact on post-trade data management. Companies must implement appropriate data security measures and obtain explicit and informed consent from individuals before processing their data. Failure to do so can result in significant fines and reputational damage.

Impact on Business Models

The General Data Protection Regulation (GDPR) has significantly changed various business models, including post-trade data management. Companies must ensure they comply with the GDPR while maintaining their business models. This section will discuss the impact of GDPR on business models, including changes in customer interaction and opportunities and challenges.

Changes in Customer Interaction

GDPR has given customers more control over their data. Companies need customers' consent before collecting, processing or storing their data. This has led to changes in customer interaction, where companies must communicate the purpose of data collection and obtain explicit customer consent. Companies must also ensure customers can easily access, modify, or delete their data upon request. These changes in customer interaction have led to an increase in transparency and trust between companies and customers.

Opportunities and Challenges

GDPR has created both opportunities and challenges for companies. On the one hand, GDPR compliance can lead to increased customer trust, resulting in higher customer retention rates and new customer acquisition. Companies can also use GDPR compliance as a competitive advantage by demonstrating data protection and privacy commitment. On the other hand, GDPR compliance can be challenging for companies, especially those that rely heavily on data processing and storage. Companies must ensure they have the appropriate technical and organizational measures to protect personal data and prevent data breaches. Non-compliance with GDPR can result in significant fines and reputational damage.

In conclusion, GDPR has significantly impacted business models, including changes in customer interaction and opportunities and challenges. Companies must ensure that they comply with GDPR while maintaining their business models. GDPR compliance can lead to increased customer trust and new opportunities, but it can also be challenging for companies that rely heavily on data processing and storage.

GDPR Compliance and Risk Management

The General Data Protection Regulation (GDPR) has significantly changed how organizations handle personal data. Compliance with GDPR is essential, not only to avoid fines and penalties but also to prevent reputational damage. The risk-based approach in GDPR requires organizations to assess and manage risks associated with data processing activities. This section will discuss how GDPR compliance can help organizations manage risks effectively.

Preventing Reputational Damage

Non-compliance with GDPR can result in reputational damage for organizations. Data breaches can significantly impact an organization's reputation, causing a loss of customer trust and loyalty. GDPR requires organizations to implement appropriate technical and organizational measures to ensure the security of personal data. By complying with GDPR, organizations can demonstrate their commitment to protecting personal data and maintaining the trust of their customers.

Avoiding Penalties and Fines

One of the primary reasons for GDPR compliance is to avoid penalties and fines. GDPR allows supervisory authorities to impose fines of up to €20 million or 4% of the global annual turnover, whichever is higher, for non-compliance. The fines can have a significant impact on the financial stability of an organization. By complying with GDPR, organizations can avoid these penalties and fines and ensure their financial stability.

Compliance with GDPR requires organizations to implement appropriate technical and organizational measures to protect personal data. Risk management is essential to GDPR compliance, as it helps organizations identify and mitigate risks associated with data processing activities. By managing risks effectively, organizations can ensure compliance with GDPR and avoid reputational damage, penalties, and fines.

Role of Technology in Compliance

The General Data Protection Regulation (GDPR) has significantly impacted the post-trade data management industry. Companies are now required to comply with strict data privacy and protection regulations. Companies leverage innovative technologies such as AI, machine learning, and cloud solutions to achieve compliance.

Utilizing AI and Machine Learning

AI and machine learning technologies have revolutionized the way companies manage their data. These technologies can analyze large amounts of data in honesty, identify patterns, and detect anomalies. By leveraging AI and machine learning, companies can automate their compliance processes, reduce the risk of human error, and ensure that they meet GDPR requirements.

Leveraging Cloud Solutions

Cloud solutions have become increasingly popular in recent years, and for good reason. Cloud solutions offer a range of benefits, including increased scalability, flexibility, and cost-effectiveness. Companies can store and manage their data securely and competently by leveraging cloud solutions. Cloud providers are also responsible for maintaining GDPR compliance, which can help companies reduce their compliance burden.

Innovation is critical to achieving GDPR compliance. Companies that embrace new technologies and innovative solutions are more likely to achieve compliance and gain a competitive advantage in the post-trade data management industry. By leveraging AI, machine learning, and cloud solutions, companies can automate their compliance processes, reduce the risk of human error, and ensure that they meet GDPR requirements.

Implications for Financial Institutions

Impact on Banks

The GDPR has significant implications for banks, particularly for post-trade data management. Banks must ensure they have the necessary systems and processes to comply with the GDPR's requirements for processing personal data. This includes ensuring that they have obtained the required consent of individuals and that they can respond to requests from individuals to access, rectify, or erase their data.

Banks must also ensure that they have appropriate data protection policies and procedures and that they can demonstrate compliance with the GDPR's requirements. This includes ensuring they have conducted a thorough risk assessment of their data processing activities and implemented appropriate technical and organizational measures to protect personal data.

In addition, the GDPR has implications for banks' financial reporting and liquidity management. Banks must ensure they can provide accurate and timely financial reports that comply with the GDPR's requirements. They must also ensure that they have appropriate liquidity management policies and procedures in place and that they can demonstrate compliance with the GDPR's requirements in this area.

Effect on Asset Managers

The GDPR also has significant implications for asset managers, particularly for managing personal data relating to investors and clients. Asset managers must ensure that they have obtained the necessary consent from individuals to process their data and that they can respond to individuals' requests to access, rectify, or erase their data.

Asset managers must also ensure that they have appropriate data protection policies and procedures in place and that they can demonstrate compliance with the GDPR's requirements. This includes ensuring they have conducted a thorough risk assessment of their data processing activities and implemented appropriate technical and organizational measures to protect personal data.

In addition, the GDPR has implications for asset managers' liquidity management. Asset managers must ensure that they have appropriate liquidity management policies and procedures in place and demonstrate compliance with the GDPR's requirements in this area. They must also ensure they can provide accurate and timely financial reports that comply with the GDPR's requirements.

Regulatory Obligations and Reporting

Post-trade data management involves various regulatory obligations and reporting requirements. One of the most significant regulations affecting post-trade data management is the General Data Protection Regulation (GDPR). The GDPR imposes strict rules on collecting, storing, and using personal data, including post-trade data. Firms must comply with the GDPR when handling post-trade data and implement appropriate measures to protect personal data from unauthorized access, disclosure, and misuse.

In addition to the GDPR, post-trade data management is subject to various other regulatory obligations, such as those imposed by the Securities and Exchange Commission (SEC), the Anti-Money Laundering (AML) regulations, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). These regulations require firms to maintain accurate and complete post-trade data records and report certain information to regulatory authorities promptly and accurately.

Firms must also ensure that they have appropriate systems and controls to monitor and verify the accuracy and completeness of their post-trade data. This includes implementing proper data validation and reconciliation procedures and conducting regular internal audits to ensure their post-trade data is accurate and complete.

In addition to regulatory obligations, firms must also be accountable for their post-trade data management practices. This includes ensuring they have appropriate policies and procedures to govern post-trade data collection, storage, and use and training staff on these policies and procedures. Firms must also ensure that they have appropriate systems and controls in place to monitor and report on their post-trade data management practices and address any issues that arise promptly and effectively and

Sustainability and corporate governance have become increasingly important in recent years, as companies are expected to operate socially and environmentally sustainable. Environmental, Social, and Governance (ESG) criteria measure and evaluate a company's performance in these areas.

Corporate governance refers to the rules, practices, and processes by which a company is governed. It encompasses the relationships among the company's management, board of directors, shareholders, and other stakeholders. Good corporate governance ensures a company is managed responsibly and ethically.

Sustainability, on the other hand, refers to the ability of a company to operate in a way that meets the needs of the present without compromising the ability of future generations to meet their own needs. This involves minimizing the company's environmental impact, promoting social responsibility, and ensuring that the company operates ethically and transparently.

The implementation of the General Data Protection Regulation (GDPR) has also had an impact on sustainability and corporate governance. The GDPR requires companies to implement measures to protect the personal data of their customers and employees. This includes ensuring that data is processed transparently and ethically and that individuals can access and control their data.

In the context of post-trade data management, the GDPR has implications for how companies handle and process trade-related data. Companies must ensure that they have appropriate measures to protect the personal data of their clients and counterparties while also ensuring they comply with regulatory requirements related to trade reporting and transparency.

Overall, sustainability and corporate governance are becoming increasingly important considerations for companies in all industries. By implementing strong ESG practices and ensuring compliance with regulations like the GDPR, companies can demonstrate their commitment to operating responsibly and ethically while protecting the interests of their stakeholders and the environment.

Future of Post-Trade Data Management

The General Data Protection Regulation (GDPR) has significantly impacted post-trade data management. The regulation has led to increased innovation and efficiency in the industry, as firms have been forced to adopt new technologies and processes to comply with GDPR requirements.

One area where GDPR has significantly impacted is the use of advanced analytics. Firms must now be more transparent about the data they collect and how they use it, which has increased demand for tools to help firms analyze and understand their data. This has led to development of new digital platforms and analytics tools to help firms comply with GDPR requirements while improving their overall data management processes.

Another area where GDPR has impacted is the efficiency of post-trade data management. Firms are now required to be more efficient in their data management processes, which has led to increased automation and standardization of data management processes. This has resulted in cost savings for firms and improved overall efficiency in the industry.

Overall, the future of post-trade data management looks bright as firms continue to adopt new technologies and processes to comply with GDPR requirements. The increased use of advanced analytics and digital platforms is expected to continue as firms look for ways to improve their data management processes and comply with GDPR.