What is the post-trade processing lifecycle?

Financial markets are exciting. You like to buy stocks. But what happens after you've bought your stock? Why must you wait two days because of the T+2 settlement cycle? Why are there so many different firms in the post trade operating model? What happened in the Gamestop crisis?

The post-trade processing workflow is essential to the stock market, ensuring that transactions are settled and recorded accurately after a trade has been executed. Financial markets are exciting. You like to buy stocks. But what happens after you've bought your stock? Why must you wait two days because of the T+2 settlement cycle? Why are there so many different firms in the post-trade operating model? What happened in the Gamestop crisis?

There Used To Be Paper Stock Certificates

You have entered the post-trade world. Stock certificates used to be physically moved between broker's offices. Market participants used paper stock certificates for centuries until the Paper Crisis of the 1970s. There are still paper stock certificates in some countries today!

Now, Stock Is Held On Electronic Registers

The development of electronic records meant a higher volume of trades could be processed. Today, capital markets expect straight-through processing as much as possible and clearing and settlement to proceed efficiently without errors.

The post-trade processing industry plays a vital role in reducing risk, maintaining compliance with regulations, enhancing the economic efficiency of markets and enabling capitalism to flourish.

Why Capital Markets Matter

Companies raise money through equity and fixed-income offerings on the public markets. Post-trade processes support these activities, including processing corporate actions and providing business solutions to engage shareholders.

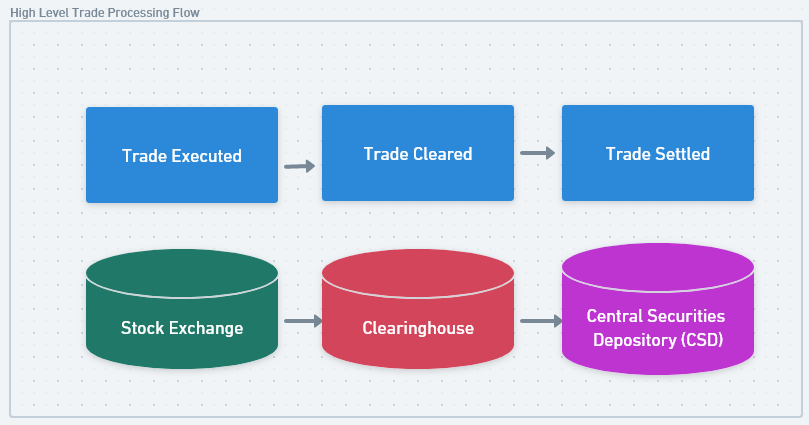

The Lifecycle of Trade Processing

The world of post-trade processing is complex. But I'll keep it simple for now. A trade is executed on a stock exchange. The trade is then cleared at a clearinghouse. Then, on settlement day, the trade is settled at the central securities depository (CSD). The cash and the securities are exchanged simultaneously. This is called Delivery versus Payment (DVP).

What Happens After A Trade Is Settled

Your stock will likely be held in "street name" when you have received it. A nominee company will keep it on your behalf and ensure your dividends are paid to your brokerage cash account. You receive any information about proxy voting from the company. Your stock can also be held by a custodian your broker-dealer appointed on your behalf. The option is also to directly register your stock ownership in your name. This is called direct registration.

As you can see, the trade processing lifecycle is quite complex, even in the straightforward model I'm describing here. The critical point is that each market participant has a vital role to play in the value chain. They all combine to deliver value to investors and issuers.

The Clearing Of A Trade

Clearing and settlement are often confused. Clearing happens after the trade is executed and before the trade is settled. In this interval, the trade must be captured, managed and monitored so everything is ready for settlement. Trade capture likely happens automatically via a feed from the stock exchange.

At the clearinghouse, a nifty bit of legal work happens. When you execute your trade, Broker A buys from Broker B. However, the clearinghouse puts itself in the process when a trade is cleared. Broker A is now buying from the clearinghouse, and Broker B is now selling to the clearinghouse.

The Process of Trade Novation

This process is called trade novation. The clearinghouse becomes the buyer to the seller and the seller to the buyer. This process changes the risk profile of the trade. The clearinghouse is now responsible for giving you your stock and the firm you bought from their cash.

The process of trade novation in the post-trade processing lifecycle enables high volumes of stock to be traded and netted at the end of each day so that the overall cash requirement is lower and an efficient market can be maintained.

The clearing process plays an essential and often overlooked part of the post-trade world. Many regulations about clearing and global standards on Financial Market Infrastructures help clearinghouses design their rules and processes.

The Settlement Of A Trade

The final stage of our basic post-trade processing operating model is the settlement of a trade. The stock is ready for settlement, sitting in the correct account, and the cash is ready for settlement, sitting in the valid account. During a settlement batch, they will match against each other. Broker A will get the stock, and Broker B will get the cash.

The Value of Post-Trade Processing

The capital markets are a multi-trillion-dollar ecosystem. Business depends on the safe and efficient processing of trades, and the key players in the post-trade process, such as broker-dealers, clearing firms, clearinghouses, custodians, and regulators, all work together to support transactions and reduce costs.

The Scale of the Post-Trade Services Industry

The post-trade services industry is a multi-billion dollar business that invests a lot of money in technology and implementing efficient processes to support new regulations and new product features that add value across asset classes and enable better risk management in an era of rising expectations on the financial industry participants.